santa clara county property tax credit card fee

If you elect to pay by credit card please be aware that these fees are added to your transaction. Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt.

Schools Out Santa Clara Unified Braces For 2021 2022 The Silicon Valley Voice

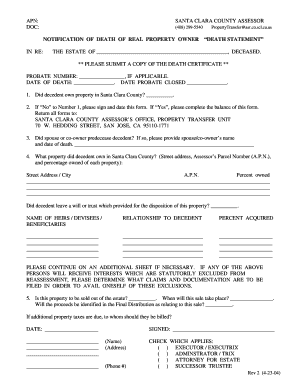

12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

. We offer free and easy options for making property tax payments such as the SCC DTAC mobile app and the eCheck payment option on our website said Margaret Olaiya Director of the County of Santa Clara Department of Tax and Collections Property owners who did not receive a bill must call the Tax Information line at 408 808-7900 and request a copy of the Secured. The current convenience fees are. Franchise Fee payments are hosted and managed by HdL Companies.

To pay your tax bill by credit card please go to the following web site. All groups and messages. Paper property tax bills are sent too but they can take a while to make it to your mailbox.

Credit Cards - Master Card Visa Discover American Express. HdL Companies Processing Center. Please make checks payable to County of Santa Clara.

CreditDebit Card 225 of the taxes being paid minimum 250 convenience charge eCheck No convenience fee for the taxpayer. Enter Property Address this is not your billing address. Transaction Fee for Charges Over 175.

2000 per deed when the Preliminary Change of Ownership form is missingincomplete see recording fee note 4. If You Use A Credit Card In Santa Clara County Can You Pay Property Tax. Santa Clara County doesnt charge a fee for paying online via electronic check e-check.

The fee amount is based upon a percentage of the transaction. If you elect to pay by credit card please be aware that these fees are added to your transaction. File and Pay Franchise Fees.

Registered Owner must present a valid government-issued ID. If you use a credit card to pay there is a minimum fee of 20. For questions about the online service contact HdL at.

429-61-001 TAX BILL INFORMATION PROPERTY ADDRESS. 2021-2022 for July 01 2021 through June 30 2022 ASSESSORS PARCEL NUMBER APN. Since the County is by law not allowed to collect less than the actual tax amount any fees for processing this credit card payment must be paid by you.

A convenience fee charged by the credit card company is passed on to the taxpayer. The average property tax rate in Santa Clara County is 067 of the market value of the home which is below the state average of 074 statewide. 730 AM - 430 PM Department of Environmental Health 1555 Berger Drive Suite 300 San Jose CA 95112.

Non-refundable processing fee of 25. Besides your payment we charge processing fees for credit cards. At the time of enrollment.

CreditDebit Card 225 of the taxes being paid minimum 250 convenience charge eCheck No convenience fee for the taxpayer. If Santa Clara County property tax rates have been too costly for you resulting in delinquent property tax payments. Visa MasterCard American Express and Discover are some of the credit cards accepted.

There is however a fee for paying by credit card. To see your bill youll need either the Assessors Parcel Number APN or the property address. Please do not send Cash.

All groups and messages. Payment Plan available to the Registered Owner only. Residents of the county can expect to pay an average of 4694 in property taxes each year.

Document copy submitted with the originals for unofficial confirmation of receipt 500 conformed copy fee provide a copy with a sufficient self addressed stamped envelope Recording Fees Note. The fee amount is based upon a percentage of the transaction. It costs 2 for each class.

Saturday Aug 27 2022 211 AM PST. Look for a company that works best for you in our list of the best property tax protest companies in Santa Clara County CA. The current convenience fees are.

Non-Indigent Payment Plan Terms and Conditions. SAN JOSE CA 95125 389996 County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR. Enter Property Parcel Number APN.

395 for charges up to 175. Read the Countys Franchises Ordinance. Click here to access online payment page.

It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction. They often bill consumers a fraction of any tax savings rather than flat out-of-pocket fee. The County of Santa Clara uses FIS to process credit card and e-check payments.

Financial Assistance Social Services Agency County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara Poised To Put Headcount Tax On November Ballot

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Book Hilton Santa Clara In Santa Clara Hotels Com

Santa Clara County Property Taxes Due Date Ke Andrews

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Assessors Public Portal Form

Santa Clara County Park Fees Parks And Recreation County Of Santa Clara

Santa Clara County Death Statement Fill Out And Sign Printable Pdf Template Signnow

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

Silicon Valley Rents Bearing Down On Low Income Families

Transfer Job Opportunities Sorted By Job Title Ascending County Of Santa Clara

Non Sworn Staff Santa Clara Police Department

Santa Clara County San Francisco Bay Area Hispanic Chamber Of Commerce Business Directory

Property Taxes Department Of Tax And Collections County Of Santa Clara